A large step into a well balanced long run is better direction of finances. In this manner, one particular alleviates from possible future debts or loans. When you are in possession of the wonderful budget calculator, a great financial plan follows straight away.

Imagine keeping track of your Finances monthly with a well-established idea of spending the proper manner? It is likely using a monthly budget calculator which aids users identify how much to spend or save depending on their own situation.

Price Range planning for the Upcoming

Budget planning helps manage earnings In a much better way and helps you understand the value of paying just on something which brings value. Even a monthly budget calculator enables far better financing and fiscal events. The matter that arises is, how exactly can you find out howto manage this calculator. It is possible by keeping a tab on all incoming and outgoing forms of capital.

Monthly budget calculation

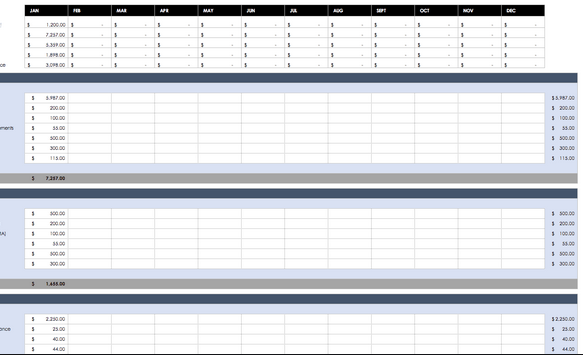

The funding calculation is made simple Employing the calculator and therefore, you have to maintain all the necessary financial information. These elaborates in More Detail:

• Cash flow and house expenditures: You needs to continue to keep a tab on monthly source of income. That is immediately followed with regular monthly expenses generally containing of the entire budget necessary to run a household. In doing this, one can have a crystal clear idea of the sum spent for rent, electricity, drinking water, home loan, etc..

• Vehicular charges: In case one is at possession of a vehicle, costs are categorized in to cost speed, gas charges, and additional mixed improvements.

• Groceries along with other individual items: the total sum spent these disagree and it is tough to really have a precise idea. However, one can approximate within a few months to have a crystal clear understanding of how much is used on meals, medicines, clothing, lifestyle, etc..

• Family costs: Including children’s instruction, child support, etc..

• Additional: Expenses ranging between banks, debts, hobbies, vacations, etc..

Letting a stable potential

By using a budget calculator, you Figuring out just how to be responsible when investing in money. It will help preparation in time plus diluting long term bills by cutting down on unneeded items.Enabling greater financing along with an educated means of investing, this calculator acts as a reliable tool in every family.