Using the current economic system, the demand for higher-web-worthy of individuals to diversify their purchase portfolios is more crucial than in the past. A good way to do this is through private storage IRAs. Even though private storage IRAs have been in existence for a few years, not many individuals know about them. In the following paragraphs, we are going to explore private storage iras and what advantages they have.

1. Exactly what is a personal storing IRA?

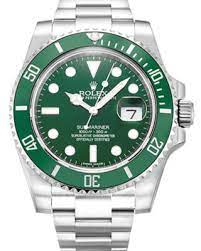

A personal storing IRA is a self-guided IRA that allows a trader to buy bodily belongings, for example best gold investment companies, and other cherished metals. As opposed to a conventional IRA, a non-public storing IRA enables a venture capitalist for taking bodily ownership in the resources they own, often known as “taking shipping and delivery.”

2. Benefits associated with a personal storing IRA

One important benefit from private storage IRAs is their ability to present an entrepreneur with security against rising prices. Cherished precious metals, particularly precious metals, have already been observed to maintain their value and also take pleasure in in times of high rising cost of living, unlike fiat currencies that have a tendency to depreciate. Thus, purchasing golden and other treasured precious metals using a private safe-keeping IRA is a great strategy to hedge against inflation.

3. Another benefit of private storage IRAs is capability to shield an investor’s money from geopolitical dangers. Since valuable metals will not be bound to any certain government or nation, they supply a method to diversify an investor’s portfolio and defend their wealth from the encounter of unpredictable international occasions.

4. A third benefit of private storage IRAs may be the prospective income tax advantage they feature. A personal-aimed IRA, such as a individual storage space IRA, permits an investor to defer spending taxes on their purchase returns until they withdraw their investment. Furthermore, if the entrepreneur is making an investment in gold or silver cafes by way of a personal storage space IRA, these kinds of pubs are classified as collectibles and are taxed at a lower price than conventional assets.

5. It’s important to note that although private storage IRAs offer you substantial rewards, they are doing come with some threats that traders should be aware of. For example, getting bodily possession of valuable materials does mean consuming obligation with regard to their safe-keeping and safety, which can be high-priced. Moreover, the varying value of valuable materials can pose a large risk, and another must be equipped for the opportunity of great unpredictability available in the market.

In conclusion, private storage IRAs provide a very good way for top-web-well worth visitors to diversify their investment portfolios with actual physical resources for example gold and silver. By using these precious precious metals, brokers acquire substantial benefits including security against rising prices, geopolitical risks, and possibly reduce taxation charges. Even so, it’s crucial to note that these investments come with danger, particularly if brokers think duty for your storage space and stability of their possessions. Therefore, any individual thinking of buying private storage IRAs need to do their study, and meet with a financial consultant before you make any judgements.